At the December 8 Council meeting, Newmarket Council approved a fiscally responsible 2.99 per cent tax increase (Town portion). The Town continues to deliver on its commitment to keeping municipal taxes as low as possible while investing in Town’s infrastructure, preparing for the future and maintaining the high level of services that make Newmarket a top place to live in Canada.

“Council and staff work very closely together all year on the Municipal Budget to delicately balance many challenges and opportunities. We always find efficiencies and savings and strive to keep our tax levy well below the GTA average, which we continue to do every year,” says Newmarket Mayor John Taylor. “Together we continue to invest in and build an incredible community that continues to be one of the very best in Canada.”

Council and staff worked diligently over many months, engaging the community throughout the process, to deliver a budget that limits the financial impact to residents as much as possible, while planning for the continued future success of the community.

The 2.99 per cent tax increase equates to an approximate $78 increase per year ($6.50 per month) for the average home. This is based on an average residential home assessed by the Municipal Property Assessment Corporation (“MPAC”) at $711,000 (based on 2016 market values). Newmarket’s tax levy remains one of the lowest in York Region and continues the Town’s commitment to keeping the levy approximately 10 per cent below the GTA average in taxes per capita.

The following outlines the average household cost per day for various Town services:

The total approved 2026 Operating Budget is $181.9 million, and the Capital Budget is $58.7 million for a combined total of $240.6 million. The 2026 Budget also includes an annual increase of $51 on the water and wastewater bill based on annual consumption of 200 cubic metres, and an annual increase of $7 for the stormwater charge based on a 465 square metre lot. The 2026 Budget will continue to be aligned with Newmarket’s Fiscal Strategy that ensures the Town’s future sustainability as a community.

Operating Budget

The Operating Budget ($181.9 million) pays for the day-to-day services including emergency and fire services from Central York Fire Services and the operation of the Newmarket Public Library. Property taxes account for 46 per cent of the operating budget with the remaining funded through other revenue sources (provincial grants, user fees, sponsorships etc.).

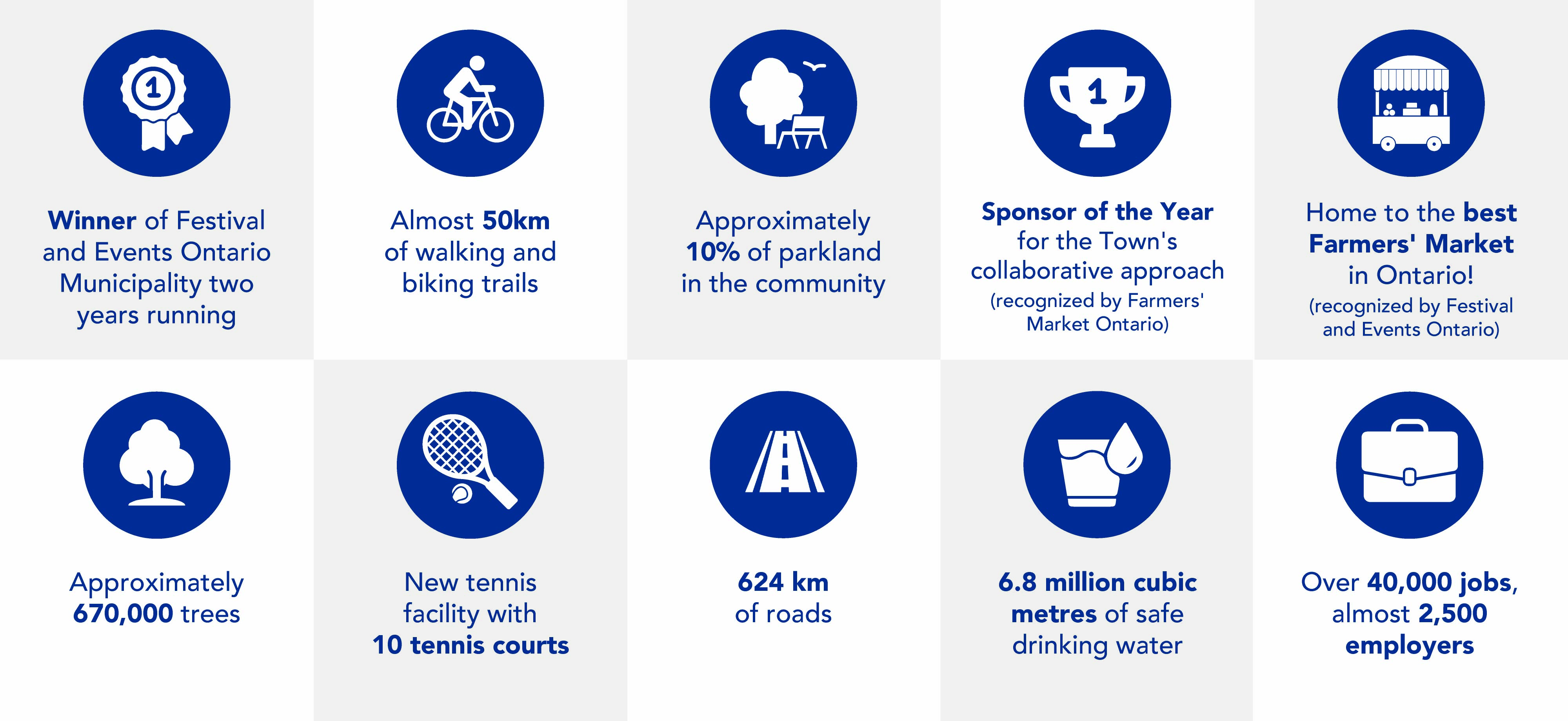

Some highlights of the service and amenities that continue to make Newmarket a top place to live and work in Canada, include:

Capital Budget

The Capital Budget funds major construction projects and repairs and upgrades to the Town’s assets and infrastructure. Capital projects are funded from dedicated sources. Highlights of the Capital Budget include:

The recently opened

Northwest Quadrant Trail Extension and boardwalk at the Environmental Park.

Continued work on Newmarket’s iconic Mulock Park – an extraordinary park for today and tomorrow.

Continued work on the Mulock Multi-Use Path which will run from Bathurst Street to Harry Walker Parkway (approx. 6 km) along Mulock Drive.

Improvements and upgrades to Newmarket’s facilities.

Road resurfacing projects to ensure safe Newmarket roads.

Continued investment into the maintenance of stormwater ponds that will reduce localized flooding and protect the environment from stormwater runoff.

Commitment to upgrades to sport pads and parkettes, as well as the new pickleball facility expected to open in 2026.

For more information on the 2026 Budget, and a more detailed breakdown of the budgets, please visit newmarket.ca/2026budget. Watch a recap of just some of the Town’s accomplishments in 2025

here.

To learn more about Council’s priorities for the 2022-2026 term and how they are setting the stage for an extraordinary future, please visit newmarket.ca/CouncilPriorities.